By Uditha Jayasinghe

COLOMBO (Reuters) – Sri Lanka’s central bank is expected to renew easing of interest rates on Wednesday, with a reduction of a quarter percentage point, as it looks to boost economic growth during the island nation’s recovery from a lingering financial crisis.

The median estimate in a Reuters poll of 13 analysts and economists predicts the central bank will reduce the Standing Deposit Facility Rate (SDFR) and the Standing Lending Facility Rate (SLFR) by 25 basis points each to 8% and 9%, respectively.

“This is the perfect time to do monetary easing,” said Dimantha Mathew, head of research at First Capital.

“There is economic recovery but trickledown to middle and lower levels has been pretty slow. So we need some amount of stimulation.”

A severe shortfall of dollars spun Sri Lanka’s economy into a deep financial crisis two years ago, contracting growth by 7.3% in 2022 and forcing a default on foreign debt.

In recent months, however, a bailout package from the International Monetary Fund, coupled with domestic measures and reforms, helped push up the rupee currency 11.3%, while inflation has disappeared, with prices falling 0.8% last month.

The economy is expected to grow 4.4% this year, for its first increase in three years, the World Bank has estimated.

The Central Bank of Sri Lanka is considering moving towards a single policy rate mechanism to ensure better signalling of its policy stance, Governor P. Nandalal Weerasinghe said in early 2024, but there has been no formal announcement yet.

Six of the 13 respondents said they expect CBSL to start announcing a single policy rate, likely to be set at 8.25%.

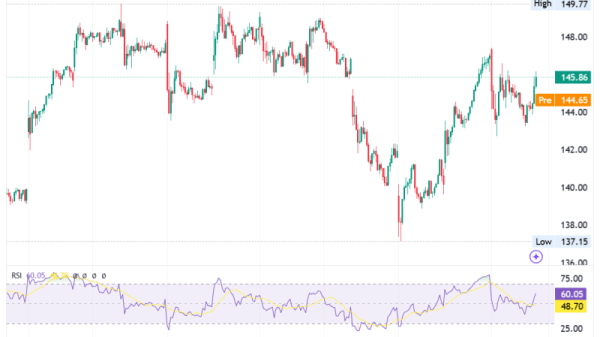

CBSL last cut rates in July but the current easing cycle that started in June 2023 has seen rates cut by a total of 7.25 percentage points, partially reversing the increases of 10.50 percentage points following the financial crisis.

Hoping to cement a stronger economic recovery, millions of Sri Lankans voted to give new President Anura Kumara Dissanayake’s coalition a landslide victory in a general election this month.

That sets the stage for the International Monetary Fund (IMF) to greenlight the fourth tranche of the $2.9-billion bailout.

An interim budget is expected to be presented in parliament and Dissanayake hopes to complete the debt restructuring by the end of December.

For individual responses, please see below table:

Organisation SDFR (%) SLFR (%)

Acuity 8 9

Softlogic 8 9

Advocata Institute 8.25 9.25

Citigroup (NYSE:C) 9

First Capital 7.75 8.75

Asha Securities 7.75 8.75

HSBC 8.25 9.25

University of 8 9

Colombo

Asia Securities 7.75 8.75

CAL Group 8 9

NDB Securities 7.75 8.75

Capital Economics 8

Standard Chartered (OTC:SCBFF) 9

Median 8 9