By Vivek Mishra

BENGALURU (Reuters) – India’s economy likely grew at its slowest pace in one-and-a-half years in the three months to end-September as weak consumption offset a strong recovery in government spending, which for years has helped drive growth, a Reuters poll found.

Asia’s third-largest economy grew more than 8.0% in the fiscal year to end-March but has since slowed sharply as skyrocketing food inflation drives up the cost of living and forces households to cut spending.

Private consumption accounts for about 60% of India’s gross domestic product (GDP) but sales of items from cars to biscuits have plummeted.

Passenger vehicle sales recorded their first decline in 10 quarters and sales of two-wheelers experienced a sharp slowdown, while lacklustre quarterly earnings from fast moving consumer goods (FMCG) company Hindustan Unilever (NS:HLL) showed the country’s consumption story was under strain.

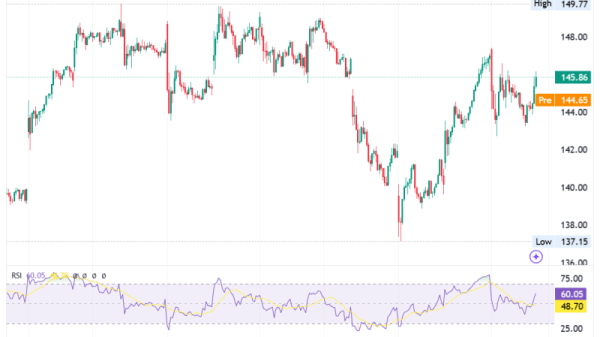

Gross domestic product in the world’s fastest-growing major economy was forecast to have increased 6.5% year-on-year in the July-September period, down from 6.7% in the preceding three months, according to the Nov. 18-25 poll of 54 economists in which forecasts ranged from 6.0% to 7.1%.

That would mark the slowest growth in six quarters and a third consecutive quarter of slowing growth. Economic activity, as measured by gross value added (GVA), was forecast to show a more modest 6.3% expansion.

“A host of high frequency indicators showed signs of slowing,” said Dhiraj Nim, an economist at ANZ.

“Manufacturing and mining growth likely slowed during the quarter. Passenger vehicle sales put up a poor show, reflecting weakness in private consumption. While government capex provided some lift, the uptick in overall public spending excluding interest payments was not as sharp as expected.”

The Reserve Bank of India (NS:BOI) (RBI), citing a rebound in private consumption, expects growth of 7.6% in the current quarter to end-December when the nation of more than 1.4 billion celebrates major festivals like Dussehra and Diwali.

However, most economists in the Reuters poll said that was too optimistic.

“I suspect (the RBI) is underestimating the length and severity of the current cyclical slowdown in growth, which is taking place amid a continued tightening in both fiscal policy and monetary policy,” said Miguel Chanco, chief emerging Asia economist at Pantheon Macroeconomics.

Economists downgraded their growth forecast for this fiscal year to 6.8% and for next year to 6.6%, from 6.9% and 6.7%, respectively, in a survey last month.

India needs consistent economic growth above 8% to generate enough jobs for the millions of young people entering the workforce.