SINGAPORE (Reuters) -U.S. President-elect Donald Trump said on Monday that on his first day in office he will impose a 25% tariff on all products from Mexico and Canada, and an additional 10% tariff on goods from China.

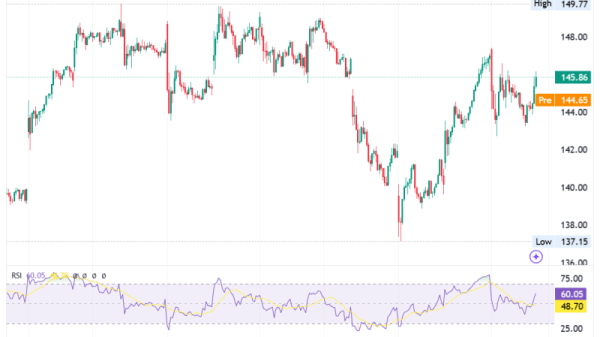

The announcement sparked a dollar rally. It rose 1% against the Canadian dollar and 2% against the Mexican peso, while share markets in Asia fell, as did European equity futures. S&P 500 futures fell 0.3%.[FRX/][MKTS/GLOB]

Here are reactions from market participants:

GARY NG, SENIOR ECONOMIST, NATIXIS, HONG KONG

“It’s definitely a shock to the market and weighing on Chinese assets, especially the export sectors because their corporate profit will be under pressure with these extra tariffs.

“But compared to what he imposed on Canada and Mexico, the magnitude is not that big, so investors might still want to see what are the follow ups and when/if the 60% promised will actually come through.”

SIMON YU, VICE GENERAL MANAGER, PANYAO ASSET MANAGEMENT, SHANGHAI

“Tariffs are Trump’s card in negotiating with other countries.

“China already has a template to deal with tariffs in reference to Trump 1.0. Regarding other clampdowns such as tech-related sanctions, China may accelerate the process of self-reliance and import substitution.”

GEORGE BOUBOURAS, HEAD OF RESEARCH, K2 ASSET MANAGEMENT, MELBOURNE

“Important to reflect that the 25% tariff headlines with China, Mexico and Canada are not policies as yet but a good indication that under a Trump presidency they will no longer tolerate the relocation of export manufacturing from China to the U.S. NAFTA partners by Chinese companies.

“Headlines like this will continue to support a steeper yield curve and stronger USD… as always when it comes to trade, fiscal or monetary policy changes, there will be long and variable lags.”

WILLIAM REINSCH, SENIOR ADVISOR, CENTER FOR STRATEGIC AND INTERNATIONAL STUDIES:

“This strikes me more as a threat than anything else.

“I guess the idea is if you keep hitting them in the face, eventually they’ll surrender.

“It didn’t work with China, and I don’t think it’ll work with Mexico and Canada.”

SHOKI OMORI, CHIEF JAPAN DESK STRATEGIST, MIZUHO SECURITIES, TOKYO

“Initial reaction on CAD, MXN, etc seems to have been big, but MXN looks resilient because it already fell against the dollar when Trump was elected.

“MXN is favoured by carry traders, so I feel MXN will be bought by dip buyers if Trump doesn’t go further.

“The impact from Bessent is overestimated. Even if he tries to control the deficit, Trump in the end has ultimate power.”

JASON WONG, SENIOR MARKET STRATEGIST, BNZ, WELLINGTON

“It feels like we’ve just had a time warp back to 2016 and markets are back to responding to tweets.

“It’s going to be a while, and this is the new norm. The market is going to be twitchy, and it’s forefront of mind, but this is how he operates…You can jump to conclusions but I wouldn’t be jumping to anything at the moment so the market just needs to get a grip. You just can’t read too much into these things.”

ROB CARNELL, REGIONAL HEAD OF RESEARCH, ING, SINGAPORE

“It reminds me a lot of four years ago, when you’d wake up every morning and markets would be whipped around by whatever the latest comment is. I’m tempted to take it with a bit of a pinch of salt. He’s not the president yet.

“This is how he gets stuff done, isn’t it? He throws stuff around, mentions various numbers, markets react and maybe it happens maybe it doesn’t.”

ALEX LOO, FX AND MACRO STRATEGIST, TD SECURITIES, SINGAPORE

“While the USMCA agreement is technically only up for renegotiation in 2026, Trump is likely trying to kickstart the renewal process early with Canada and Mexico through today’s tariff announcements. MXN and CAD had a kneejerk reaction lower but thin liquidity outside North America time zone may have contributed to the outsized moves seen in Asia this morning.”

SEAN CALLOW, SENIOR FX ANALYST, ITC (NS:ITC) MARKETS, SYDNEY

“It was just last month that Trump said that ‘the most beautiful word in the dictionary is tariff’ so there really should not have been a surprise in Trump’s intention, just in the timing of the comments.

“The fall in trade-sensitive currencies makes sense and should persist near term given the quiet calendar, but Fed policy should return to the fore once we get closer to the December FOMC meeting.”

KHOON GOH, HEAD OF ASIA RESEARCH, ANZ, SINGAPORE

“It looks like he’s not going to waste much time… so the question now is – on day 1 is he actually going to follow through with it and will the tariffs hit on day 1?

“The other interesting thing is he’s laid out his reasons for the tariffs (relating to the movement of people and drugs) so it looks like these tariffs are conditional on those. Whilst this is the opening salvo, maybe this is just the beginning of the deals he’s well known for.”

TONY SYCAMORE, MARKET ANALYST, IG MARKETS, SYDNEY

“I’m just trying to reconcile how it works with the appointment of Bessent. People have been expecting him to be a more moderate voice. Maybe it’s also a reaction to hey, look, everyone thought that Bessent was gonna moderate some of those more extreme trade policies … but Trump’s not gonna be moderated by anyone.

“He has said up to 60% on Chinese goods.. so if we’re only talking about an additional 10% tariff on Chinese goods on top of the existing levies, that’s a lot less than what he had previously indicated. .. so it may be actually less than the worst case scenario we were looking at.”

MATT SIMPSON, SENIOR MARKET ANALYST, CITY INDEX, BRISBANE

“It’s almost as if Trump wants to remind markets who is in control, after nominating Scott Bessent as Treasury Sec – a man markets expected to cool Trump’s potency. But with the Canadian dollar rising against the Mexican peso, markets are assuming this will hit Mexico the hardest.”