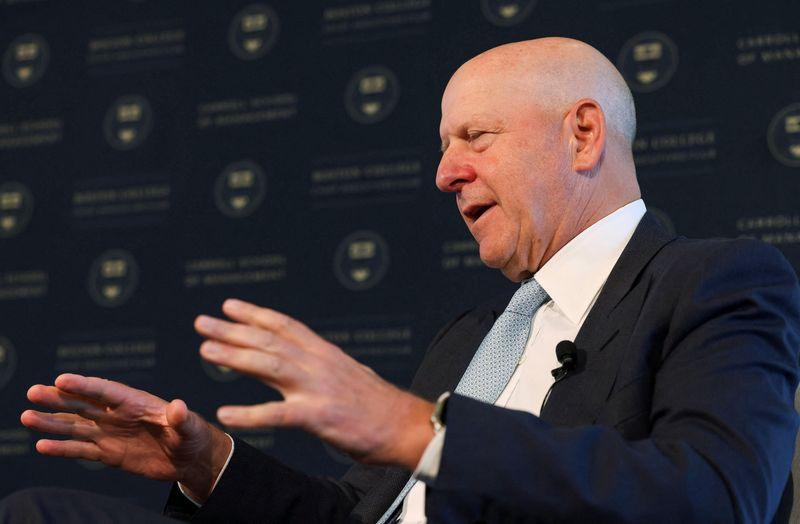

LONDON (Reuters) – The CEOs of Goldman Sachs and Morgan Stanley said on Tuesday they expected corporate dealmaking to pick up in 2025, while the CEO of Apollo Global Management (NYSE:APO) said he expected a presidential victory by Donald Trump would spur more deals.

Ted Pick, CEO, Morgan Stanley, told a panel debate at the Future Investment Initiative (FII) conference in Riyadh that the increase in activity would “be a global phenomenon”, with bigger companies going public. Goldman boss David Solomon said on the same panel he also expected more robust activity next year.

Apollo Global Management CEO Marc Rowan said a Donald Trump victory in the upcoming U.S. presidential election would free up merger and acquisition activity and lead to investment liberalisation.