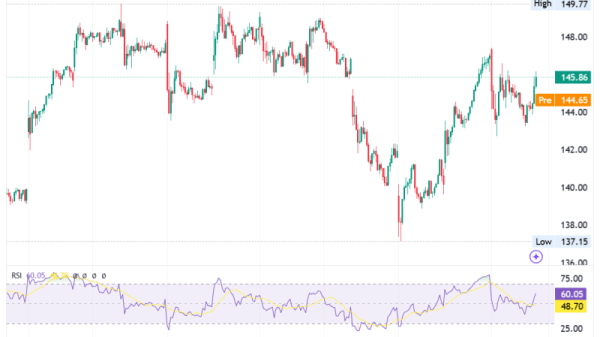

(Reuters) – Gap shares soared 15% premarket on Friday, as a return to growth at all four of its brands after nearly two years encouraged the apparel retailer to lift its annual sales forecast in a robust start to the holiday shopping season.

The Banana Republic parent’s expectations of strong tidings during the holiday period come close on the heels of Walmart (NYSE:WMT)’s forecast of a resilient consumer but contrast with muted sales by Target (NYSE:TGT), amplifying prospects of a mixed shopping period.

CEO Richard Dickson, who took the helm in August 2023, has pushed to revamp the in-store experience and sell at full prices, tapping into the trend of customers ready to pay more for trendy and fresh styles.

“Efforts to rebuild the customer base and roll out new marketing strategies are attracting new, higher-value shoppers,” Dana Telsey of Telsey Advisory Group said.

Gap expects annual net sales to rise between 1.5% and 2%, compared with its earlier target of slightly up.

Its two struggling brands posted growth in third-quarter sales. Athleisure unit Athleta’s sales rose 4% while Banana Republic posted a 2% jump.

“Holiday is off to a strong start,” Dickson said. “We gained market share across all brands. That’s actually the seventh consecutive quarter that we’re posting market share gains for the company and against the backdrop of a challenged industry.”

The company is also addressing a shorter shopping season this year with only 26 days between Thanksgiving and Christmas, sprucing up competition and intense promotion among retailers.

“As it relates to the compressed holiday shopping window, right now, we are focused on winning early … ,” CFO Katrina O’Connell said.

“We are working hard to compete to win with newness and product, compelling marketing, and some strategic promotions.”

Gap’s forward price-to-earnings ratio for the next 12 months, a common benchmark for valuing stocks, was 10.85, compared with 9.03 for American Eagle Outfitters (NYSE:AEO) and 13.06 for Abercrombie & Fitch.