(Corrects to show that Yellen became Council of Economic Advisers chair in 1997, after CDFI fund was launched, in paragraph 2)

WASHINGTON (Reuters) – Former President Bill Clinton will return to the U.S. Treasury Department for the first time in nearly 25 years on Thursday to mark the 30th anniversary of a community lending fund launched during his presidency but which could be put at risk by President-elect Donald Trump’s new government efficiency body.

WHY IT’S IMPORTANT

The Treasury Department said that Clinton will join Yellen in a program to underscore the importance of the Community Development Financial Institutions Fund in supporting small businesses and families in minority and underserved communities. The fund was launched in 1994. Yellen became chair of Clinton’s Council of Economic Advisers in 1997.

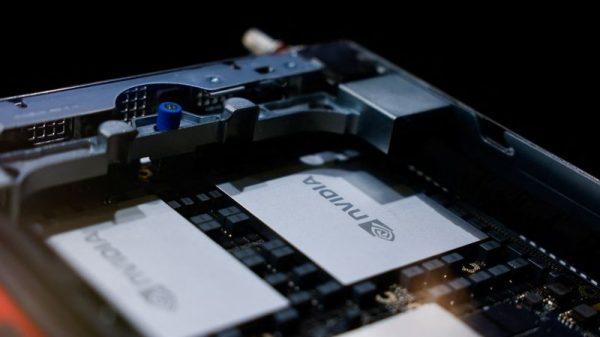

Trump has put billionaire Tesla (NASDAQ:TSLA) and SpaceX CEO Elon Musk and former presidential candidate Vivek Ramaswamy in charge of a non-government panel tasked with slashing trillions of dollars in federal spending.

In his first budget plan for fiscal 2018, Trump proposed eliminating the CDFI Fund’s grant money to save $210 million, arguing that the program was no longer needed as community lenders by then had ready access to capital.

A spokesperson for Trump’s transition team could not immediately be reached for comment on whether the program would again be targeted for cuts. By the end of Trump’s term in December 2020, he signed into law some $12 billion in investments into CDFI lenders to help keep small businesses afloat during the depths of the COVID-19 pandemic.

BY THE NUMBERS

Since its inception, the CDFI Fund has provided lenders in minority and underserved communities with $8 billion in grants, $3 billion in bond guarantees and $81 billion in tax credits to expand the capacity of some 1,400 community lenders in minority and underserved communities.

Yellen announced in June that the CDFI Fund would provide an additional $100 million over the next three years to support the production of affordable housing.

KEY QUOTE

“As we look back over the last 30 years, it is remarkable how significant a role the CDFI Fund has played in fueling economic development in countless communities across the United States, and we look forward to continuing this important work in the years ahead,” Yellen said in a statement about the program’s anniversary in September.

(This story has been corrected to show that Yellen became the Council of Economic Advisers chair in 1997, in paragraph 2)