Investing.com– Most Asian stocks rose on Friday, buoyed by strength in chipmaking and cyclical stocks, which helped markets weather heightened tensions over the Russia-Ukraine war.

Regional markets took some positive cues from Wall Street, with chipmaking stocks tracking strength in NVIDIA Corporation (NASDAQ:NVDA), which hit a record high on Thursday.

But broader tech stocks were rattled by a sharp drop in Alphabet Inc Class A (NASDAQ:GOOGL) after U.S. authorities made several recommendations to break up the firm’s alleged monopoly in online search.

U.S. stock index futures were flat in Asian trade, as risk appetite was battered by heightened tensions between Russia and Ukraine. Moscow launched an advanced hypersonic missile on a Ukrainian facility this week and threatened nuclear retaliation for Kyiv’s use of Western-made, long-range missiles.

Most Asian stocks rose past weak risk appetite on Friday, although they were still nursing some losses for the week.

Japanese shares rise past middling economic data

Japan’s Nikkei 225 index added 1.2%, while the TOPIX rose 0.8% on gains in tech and cyclical sectors. Both indexes were also headed for mild weekly losses.

Economic readings offered mixed cues on Japan’s economy. Consumer price index inflation data read slightly higher than expected for October, with underlying inflation rising further above the Bank of Japan’s 2% target. Sticky inflation is likely to invite more rate hikes by the BOJ, with a meeting scheduled for December.

Japanese business activity underwhelmed, with purchasing managers index data showing manufacturing activity shrank more than expected in November. Services activity also barely expanded during the month.

Broader Asian markets were mostly upbeat on Friday. Australia’s ASX 200 rose 1.1%, benefiting greatly from a shift into economically sensitive sectors. The index was also close to record highs.

Australian PMI data showed a contraction in both manufacturing and services activity.

South Korea’s KOSPI rose 1.2%, buoyed by an over 4% jump in memory chip giant SK Hynix Inc (KS:000660), as it tracked strength in Nvidia. While Nvidia’s revenue guidance for the current quarter had initially underwhelmed markets, analysts still maintained a largely positive view on the stock, citing continued demand from artificial intelligence.

Chinese stocks lagged, with the Shanghai Shenzhen CSI 300 and Shanghai Composite indexes losing 0.5% each. Hong Kong’s Hang Seng index shed 0.2%, as sentiment towards China was quashed by a lack of details on more stimulus measures.

Indian stocks nurse losses amid Adani jitters

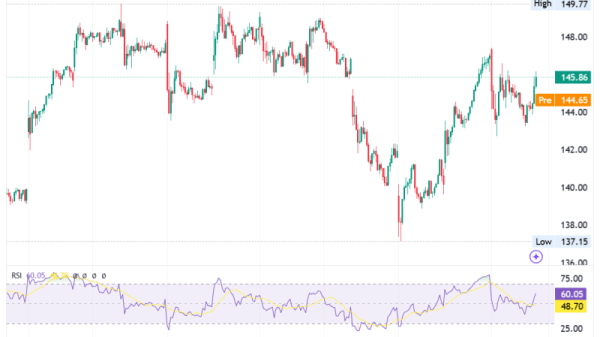

Futures for India’s Nifty 50 index pointed to a flat open, after the index slid to an over five-month low on Thursday.

The Nifty was already nursing steep losses through October, having fallen into correction territory after losing over 10% from a September record high.

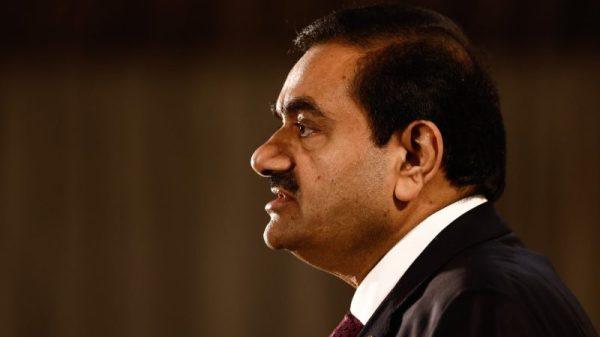

Sharp (OTC:SHCAY) losses in shares under the Adani Group added to the Nifty’s decline on Thursday, after the conglomerate’s Chairman Gautam Adani was indicted in the U.S. over allegations of bribery and corruption.

The conglomerate’s flagship Adani Enterprises Ltd (NS:ADEL) slid 22.6%% on Thursday, while Adani Ports and Special Economic Zone Ltd (NS:APSE) lost nearly 14%.