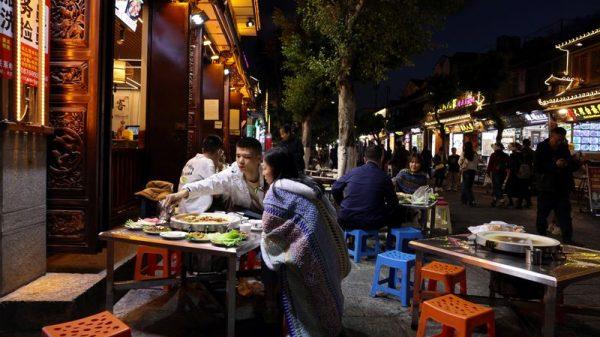

BEIJING (Reuters) – China’s services activity expanded at the fastest pace in seven months in December, driven by a surge in domestic demand, but orders from abroad declined, reflecting growing trade risks to the economy, a private sector survey showed on Monday.

The Caixin/S&P Global services purchasing managers’ index (PMI) rose to 52.2 in December from 51.5 the previous month. The growth pace was the fastest since May 2024, surpassing the 50-mark that separates expansion from contraction on a monthly basis.

The findings broadly align with China’s official PMI released last week, which indicated non-manufacturing activity recovered to 52.2 from 50.0 in November.

China’s economy has struggled over the past few years, weighed down by weak consumption and investment, and a severe property crisis. Exports, one of the few bright spots, could face more U.S. tariffs under a second Trump administration.

To revitalise the faltering economy, authorities introduced a blitz of fiscal and monetary measures in recent months.

“Since late September, the synergy of existing policies and additional stimulus measures has continued to act on the market, producing more positive factors,” said Wang Zhe, Senior Economist at Caixin Insight Group.

The survey showed the new business sub-index rose to 52.7 in December from 51.8 in November. However, new business inflows from abroad fell for the first time since August 2023.

Companies reduced staff for the first time in four months, with some citing cost concerns, including rising input material prices and wages.

Wang said prominent downward pressures persist with tepid domestic demand and mounting unfavourable external factors: “The external environment is expected to become more complex this year, requiring early policy preparation and timely responses.”

A business confidence reading remained positive but dipped to the second-lowest since March 2020, as some companies expressed concern over rising competition and potential international trade disruptions.

Donald Trump, who will take office for a second time as U.S. president in January, has vowed to impose tariffs exceeding 60% on Chinese goods, posing a major risk for the world’s second-biggest economy.

The Caixin/S&P Global Composite PMI, which combines the manufacturing and services PMIs, declined to 51.4 from 52.3 in November.