By Alexandra Alper

WASHINGTON (Reuters) – U.S. President Joe Biden on Friday followed through on his pledge to block Nippon Steel’s $14.9 billion bid for U.S. Steel, citing concerns the deal could hurt national security.

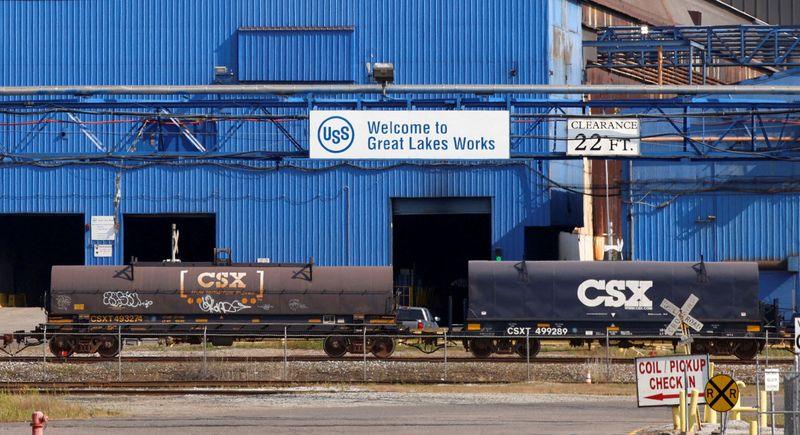

The move, long expected, cuts off a critical lifeline of capital for the beleaguered American icon, which has said it would have to idle key mills without the nearly $3 billion in promised investment from the Japanese firm.

It also represents the final chapter in a high profile national security review, led by the Committee on Foreign Investment in the United States (CFIUS), which vets investment for national security risks and had until Dec. 23 to approve, extend the timeline or recommend Biden block the deal.

The proposed tie-up has faced high-level opposition within the United States since it was announced a year ago, with both Biden and his incoming successor Donald Trump taking aim at it as they sought to woo union voters in the swing state of Pennsylvania, where U.S. Steel is headquartered. Trump and Biden both asserted the company should remain American-owned.

The two companies had sought to assuage concerns over the merger. Nippon offered to move its U.S. headquarters to Pittsburgh, where the U.S. steelmaker is based, and promised to honor all agreements in place between U.S. Steel and USW.

The merger appeared to be on the fast-track to be blocked after the companies received an Aug. 31 letter from CFIUS, seen by Reuters, arguing the deal could hurt the supply of steel needed for critical transportation, construction and agriculture projects.

But Nippon Steel countered that its investments, made by a company from an allied nation, would in fact shore up U.S. Steel’s output, and it won a 90-day review extension. That extension gave CFIUS until after the November election to make a decision, fueling hope among supporters that a calmer political climate could help the deal’s approval.

But hopes were shattered in December when CFIUS set the stage for Biden to block it in a 29-page letter by raising allegedly unresolved national security risks, Reuters exclusively reported.

JAPANESE ENTREATIES

Japanese Prime Minister Shigeru Ishiba in November urged Biden to approve the merger so as to avoid marring recent efforts to strengthen ties between the two countries, Reuters exclusively reported.

A spokesperson for Ishiba could not be reached for comment on Friday prior to Biden’s statement. Japan is a key U.S. ally in the Indo-Pacific, where China’s economic and military rise has raised concerns in Washington, along with threats from North Korea.

Nippon Steel had aimed to raise its global output capacity to 85 million metric tons a year from 65 million now, nearing its long-term goal of taking capacity to 100 million tons.

U.S. Steel has previously said the deal’s failure would put at risk thousands of jobs and it might be forced to close some steel mills, an assertion the USW union called baseless threats and intimidation.