By Niket Nishant and Chris Prentice

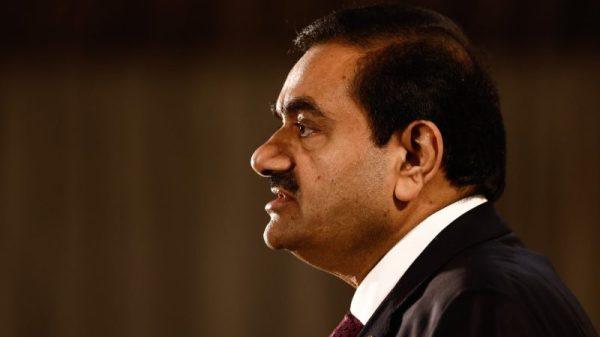

(Reuters) – Robinhood Markets (NASDAQ:HOOD)’ Chief Legal Officer Dan Gallagher on Friday withdrew from consideration for chair of the Securities and Exchange Commission in the Trump administration, leaving other Republican former SEC officials among the top candidates.

“I’ve made it clear to the relevant people that I’m not interested in being considered for the role,” he told CNBC.

Gallagher said in a statement he was committed to Robinhood and the retail brokerage’s customers.

Industry sources said restrictions on public officials’ investments were a potential deterrent for Gallagher, who served as an SEC commissioner from 2011 to 2015.

Gallagher was the frontrunner for the job, Reuters and other media outlets reported earlier this month, citing sources familiar with the matter. His candidacy was supported by cryptocurrency executives, an important source of campaign finance for President-elect Donald Trump.

Trump spokesperson Karoline Leavitt did not comment directly on Gallagher’s announcement but said Trump was still deciding who would serve in his administration.

Gallagher’s decision to bow out opens the door for other contenders.

Reuters and other media have reported former SEC commissioner Paul Atkins, CEO of consultancy Patomak Global Partners (NYSE:GLP), and Willkie Farr & Gallagher law firm partner Robert Stebbins, who served as SEC general counsel during Trump’s first administration, were also being considered for SEC chair.

A person with knowledge of the matter said on Thursday evening that they were still contenders. Neither Atkins nor Stebbins immediately returned a request for comment

Another potential candidate is Teresa Goody Guillén, partner at law firm BakerHostetler and co-lead of its blockchain team, Coindesk reported on Tuesday. She declined to comment when contacted by Reuters on Wednesday and did not immediately respond to a request for comment on Friday.

The cryptocurrency industry is seeking a complete overhaul of SEC crypto policy, ending a crackdown by the SEC’s current chair, Gary Gensler, who leaves office in January before Trump’s inauguration.

Atkins, who served on Trump’s transition team in 2016 when he was also a contender for SEC chair, is a crypto enthusiast, while Stebbins has been criticized by some crypto executives for his role in crypto enforcement actions during his time at the agency.

Trump’s transition team has spoken with as many as a dozen potential candidates for the job, according to multiple sources and media reports. A decision is likely to wait until a Treasury secretary is announced.