By David Milliken

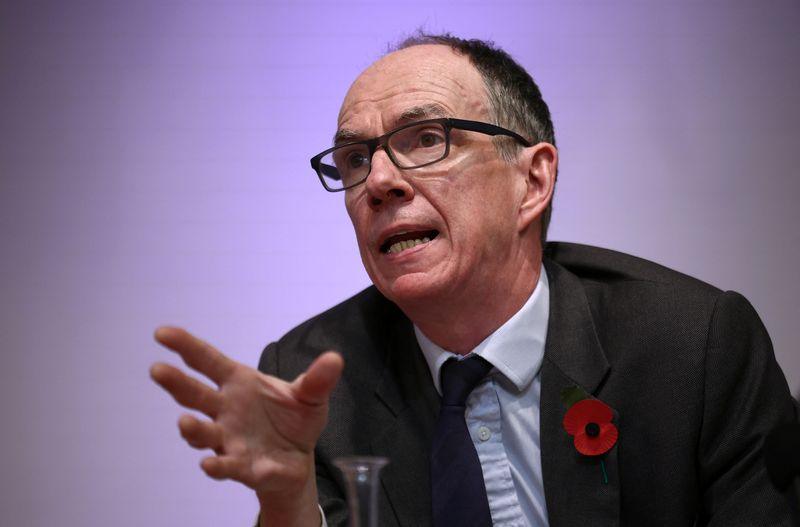

LONDON (Reuters) -British inflation is at least as likely to undershoot the Bank of England’s latest forecasts as it is to match them, potentially requiring faster rate cuts, Deputy Governor Dave Ramsden said on Wednesday.

Ramsden voted for the BoE to start cutting rates in May – three months before a majority on the Monetary Policy Committee backed loosening policy – and joined the majority earlier this month who backed a second quarter-point rate cut to 4.75%.

After its latest rate cut, the BoE said future loosening would be gradual and forecast inflation would stay above its 2% target until early 2027, partly because of stimulus in the new Labour government’s first budget and a higher minimum wage.

Ramsden said such an outcome was “plausible” but that he put at least as much weight on a scenario under which inflation fell faster “consistent with more symmetry in wages and price setting, with less domestic inflationary pressure”.

A BoE survey of employers showed they were finding recruitment easier than at any time since 2017, while official data showed the fewest job vacancies relative to the level of unemployment since before the COVID-19 pandemic, Ramsden said.

Employers next year are likely to raise annual pay settlements by an amount in the bottom half of a 2-4% range which they had reported to BoE staff, he predicted.

“This would imply a scenario in which inflation stays closer to the 2% target throughout the first part of the forecast and falls below 2% more materially later on, lower than in the MPC’s published forecasts,” he said in a lecture to students at the University of Leeds.

Slightly higher than expected inflation data for October, released earlier on Wednesday, did not change his outlook, Ramsden said during a question and answer session afterwards.

BUDGET IMPACT

However, he said significant uncertainties around the impact of higher taxes on employers in the latest budget as well as persistent measurement problems in official labour statistics, did require a “watchful and responsive” approach.

“Were those uncertainties to diminish and the evidence to point more clearly to further disinflationary pressures… then I would consider a less gradual approach to reducing Bank Rate to be warranted,” he added.

The BoE’s central forecasts this month were based on market expectations from before the budget of interest rates falling to 3.75% by late 2025. Markets now only see two or three quarter-point BoE rate cuts next year, less than is forecast for the U.S. Federal Reserve or the European Central Bank.