By Pete Schroeder

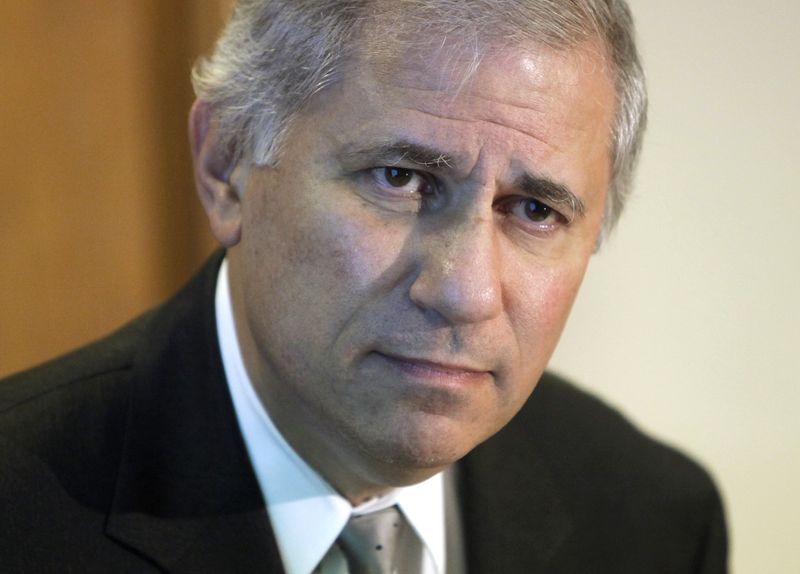

WASHINGTON (Reuters) -Federal Deposit Insurance Corporation Chairman Martin Gruenberg will retire effective Jan. 19, he told colleagues on Tuesday, clearing the way for Republican President-elect Donald Trump to name new leadership to one of the top U.S. bank regulators.

The pending departure of Gruenberg, a Democrat and Wall Street critic who had been a senior leader at the FDIC for nearly two decades, comes at a critical time for the agency – more than 18 months since three big banks failed and ahead of what is expected to be a major shake-up of bank regulation under Trump.

In a message sent to employees at the FDIC, Gruenberg said he had informed President Joe Biden of his decision, which is likely to speed up Trump’s promised plan to slash burdensome regulations.

“It has been the greatest honor of my career to serve at the FDIC. I have especially valued the privilege of working with the dedicated public servants who carry out the critically important mission of this agency,” he wrote.

Gruenberg had clung to his job since November 2023 when a Wall Street Journal report exposed widespread misconduct at the FDIC. The report was confirmed by a damning external review that also called into question Gruenberg’s leadership.

Gruenberg has previously vowed to address longstanding cultural issues at the agency.

Gruenberg announced in May he would step down once his successor was confirmed, but the Senate has yet to advance Biden’s pick, Commodity Futures Trading Commission official Christy Goldsmith Romero. On Monday, the top Republican on the Senate Banking Committee, Tim Scott, said he would not vote on her nomination, and called on Biden to withdraw it.

While Gruenberg’s term expires in 2028, lobbyists and analysts widely expected Trump would try to remove him, citing the FDIC’s toxic workplace issues identified by the independent report. Gruenberg’s decision to resign avoids a potentially messy fight and allows Trump to install his own chair.

Upon his departure, the FDIC chair role will pass to Travis Hill, the agency’s vice chair and a Republican, whom Trump transition officials are also considering for the top job permanently, Reuters reported this month.

A spokesperson for Hill did not immediately respond to a request for comment.

Gruenberg has been at the FDIC since 2005 and is the longest-serving FDIC board member in the agency’s 89-year history. During that time he served as its chair twice – once under President Barack Obama and the second under Biden.

Gruenberg and other bank regulators are due to testify before Congress on Wednesday.